Moving on Up: Developing and Managing Your M&A Prospects (For ongoing cash flow continuity)

One of the most effective business development strategies for an M&A advisor is the development and management of a good prospecting plan. Neil Thomson, an M&A Source member, and owner of Exit This Way Consulting, specializes in exit planning, appraisals, and business sales in Western Canada since 2009. He shares his plan with fellow members to help them build and grow a sustainable advisory company in the lower mid-market.

Developing – Turning Suspects into Prospects

Want to move your brokerage business model upmarket with deals that are $2,000,000 plus Enterprise Value (EV) or more? A great strategy is to specialize in an industry, especially if you have experience working or doing deals in that industry. First build a target list of businesses in that industry that meet or exceed the target criteria. How do you know if a suspect business fits your criteria? If you choose manufacturing, typically a business of that size will have 20+ or more employees:

- A good industry Rule of Thumb (RoT) is for all employees, on average, to generate $250,000 revenue.

- Twenty employees would therefore yield a top line annual revenue of about $5,000,000.

- Expect to see a minimum 10% restated EBITDA, after Cap/Ex, of around $500,000.

- At an assumed 4.0x multiple for the manufacturing sector in this range of cash flow (including Normal Working Capital) we should have a target suspect in the range of $2,000,000 EV.

How do you get to this kind of list? There are many sources to purchase an industry list made up of companies with only twenty or more employees. Next, call the contact on the list and talk to the Owner:

- Confirm the employees’ size – owners love talking about how many employees they have (while they may be very reluctant to discuss even top line revenue, let alone bottom-line Net Income).

- Find out the fiscal year end – another reasonably safe disclosure question.

- If you can, get the owner’s age – usually anyone over sixty is likely in the target range for selling.

- Talk about the owner’s exit plan:

- Any family in the business?

- Ownership structure?

- Get the best confidential email address and cell phone (bypass the gatekeeper).

- Get consent to stay in touch – to email your newsletter.

You can now weed out the companies that do not meet your criteria as a prospect.

Managing the List

Call the prospect list twice a year to stay on their radar screen and keep the information updated. Find out:

- At fiscal year end – how was it … up, down, or level? Ask if now is the time to start the selling process?

- At six months after year-end the owner should have his external accountant’s Annual Financial Statement Report – if they are in the ready-to-sell mindset, ask if you can get a copy and prepare a proposal.

For Prospects Not Ready to Sell

Develop and execute religiously on a Drip Marketing Campaign, using a service like Constant Contact (CC). You should send out at least two email newsletter eblasts per year. See example. We use the quarterly IBBA M&A Market Pulse survey results for the newsletter content dealing with market multiples trends.

Finding Your Next Interested Prospect

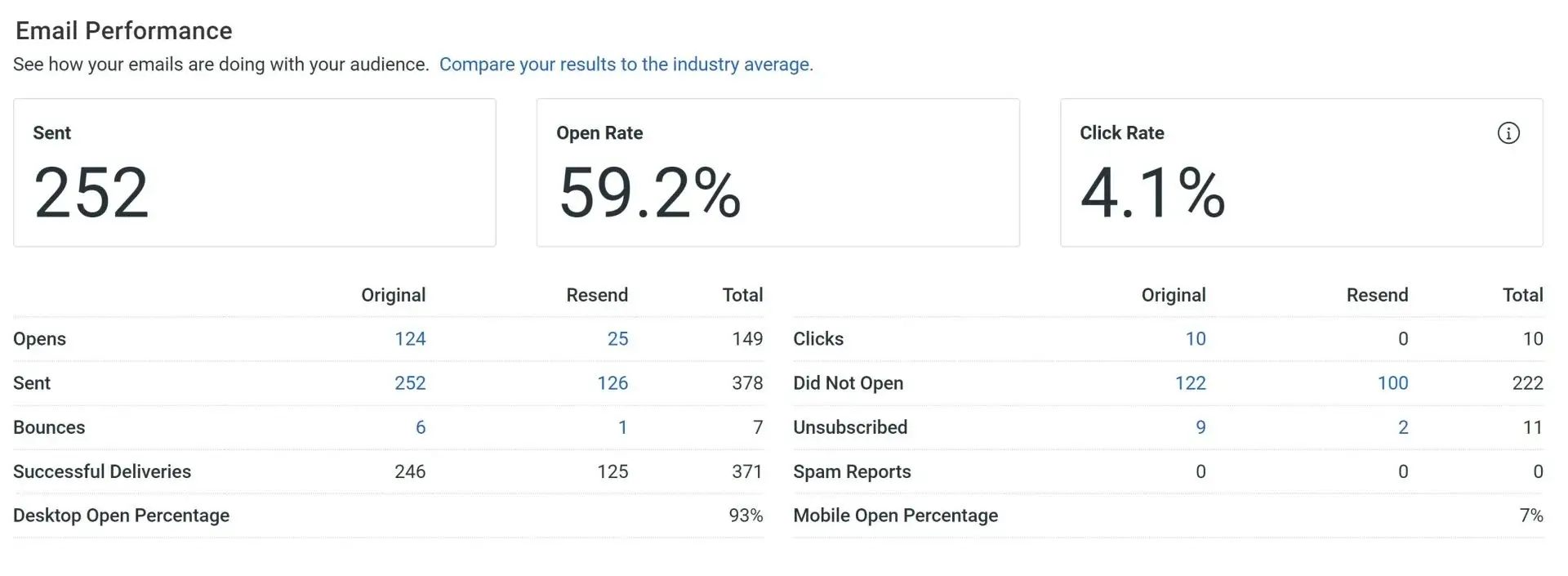

After each newsletter eblast, use the CC data on the website (example shown below), to identify the interested prospects.

The information on the site that is valuable:

- Clicks – means somethings cooking, they are interested – better call and have a conversation.

- Bounces – email has changed – better call.

- Unsubscribes – probably they have SOLD, better call and collect your Loss Review information.

Use the CC “Resend” option, one week later, to reblast the newsletter to the DID NOT OPENs …. which usually get an additional 10% Open Rate onto the overall Campaign Open Rate. Working from a quality list over a period of time where your brand is recognized and trusted, you should see a 40% – 60% Open Rate. Over time, you should also track the companies that NEVER OPEN, or the email address that is BLOCKED or SUSPENDED and decide whether you should contact them directly. Some corporate email servers block all CC-type emails, while individual email desktop programs may automatically dump CC-type email into junk.

Combining your internal prospect data knowledge together with your campaigns’ data results, should provide a worthwhile short-term A-List set of targets to actively focus on. Remember to visit weekly your CC campaign reports’ OPEN data, as some prospects will reopen the newsletter multiple times and/or from multiple devices and/or over a number of weeks – these could also be interested prospects that likely should be called.

Managing a Drip Marketing Campaign (two times a year) is not an onerous workload even while simultaneously managing your Engagements Under Offer or Closings and should facilitate new in-bound engagements and ongoing cash flow continuity (subject to market fluctuations).

M&A is a long game requiring phenomenal patience … many of our closings over the last two years have been prospects that have been 10 years plus in our system.

Questions or comments on this article can be directed to:

Neil Thomson, CBI, M&AMI

Neil Thomson, CBI, M&AMI

[email protected]

250.870.6813

https://exitthiswayconsulting.com/about-us/