Successfully Navigating the SBA Lending Process

For buyers seeking acquisition financing, an SBA 7(a) loan can be a fantastic tool. Relative to conventional loans that typically require down payments of 30% or more, buyers utilizing SBA loans can make a down payment of 10-25% (more on this later), and obtain a low fixed rate (a small amount above WSJ prime rate) with payments amortized over for 10 years with no pre-payment penalty. While the SBA lending process can be opaque at times and can subject the parties to uncertain timelines and potentially modified deal structures, the process worked very well for one of our recent clients, a multi-million dollar precision aerospace parts fabricator. The following outlines our experiences and lessons learned navigating the SBA 7(a) loan process.

Background and Strategy for Pricing the Business

As M&A advisors, effectively valuing businesses is one of the largest challenges we face. Let’s take a recent example modeled after a transaction we recently completed. In this case, the revenue and profit declined after the founder passed away in 2014. Prior to the founder’s illness, the business was earning between $900,000 and $1 million in annual adjusted earnings before interest, income taxes, depreciation and amortization (“EBITDA”). After the sons took over the business in FY14, performance suffered for two years, but recovered in FY17 and eventually grew to record levels, as you can see from the summary financials provided below. For these reasons, it was a challenging business to value.

Setting Buyer and Seller Expectations and Working with Preferred SBA Lenders

After a few discussions with the sellers over several months in late 2018, we were able to get their agreement to go-to-market with an asking price consistent with our estimation of market value, which included a five-year seller note for about 15% of the asking price. We began to prepare the marketing materials in November with the plan to go-to-market after the holidays in early January. We also reached out to three SBA lenders that would possibly provide an ‘expression of interest’ letter, and more importantly, highlight potential challenges to closing, which would be included in the Confidential Information Memorandum (“CIM”) and help mitigate potential risks during the deal process. While lender expression of interest is not a guaranty of the bank’s approval to lend, it can be helpful as a means to identifying potential barriers to funding and closing.

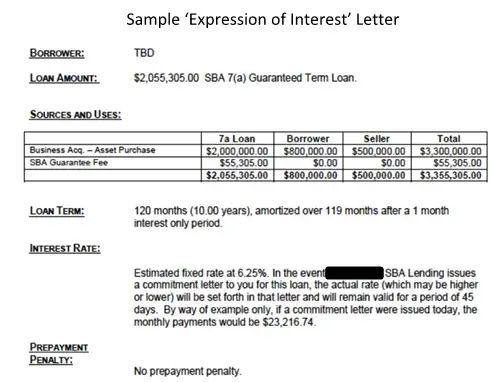

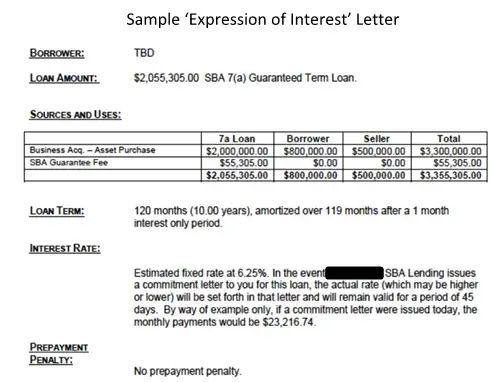

We reached out to three lenders that were part of the Preferred Lenders Program (PLP.) PLP lenders have been delegated authority by the SBA to process, close and service most SBA-guaranteed loans without prior SBA review. All three banks issued ‘expression of interest’ letters (sample provided on right) for approximately 60% of the total deal value with a 10-year amortization, no pre-payment penalty, and assumed a 25% buyer cash infusion at closing. A lower down payment from the buyer would be possible, but from what the bankers explained, a down payment of less than 25% would prevent the buyer from paying off the seller note for at least two years. This is referred to as a ‘stand-by’, and naturally, the sellers were opposed to this.

The bankers pointed out several potential challenges to closing, including:

- Inconsistent Revenue and Earnings – as stated above

- Customer Concentration – approximately 45% of sales were to a single customer; sufficient data would need to be provided to get the underwriter comfortable with the perceived risk

- Excess Salaries to Family Members– there are several family members receiving compensation through the business. Sellers would have to provide evidence for which family members do and do not work in the business. One bank mentioned that salaries could be considered excessive by the underwriter and some percentage may not be counted as approved add-backs.

- Seller Note To Be At Least 5 years – The banks differed on the minimum term of the seller note, given the various cash flow ratios they seek. One bank mentioned that the seller note would need to be paid over a minimum of seven (7) years.

- Maximum Compensation for Sellers Post-Closing as Consultants – The buyer desired the sellers to stay on as consultants for a period of time. The SBA will not allow sellers to stay on for more than one year and to meet the desired cash flow ratios, the bank capped the amount of consulting fees that could be paid to sellers.

As the banks were helpful in highlighting these potential issues, between the buyer, seller, and banker, we were able to develop explanations and risk mitigation plans for each. These explanations were written into the CIM and were also documented in a narrative document that the banker used to communicate to the underwriting department and later, with the third-party appraiser.

‘Going to Market, ‘Executing an LOI and Evaluating SBA Lenders

We took the business to market in January 2019 and were overwhelmed with volume and quality of interested buyers. After the first three weeks, we had executed 85 NDAs. After the 5th week, we had 11 full price offers and by mid-February, we had narrowed the buyer pool down to three finalists, all of whom needed an SBA loan. By February 15, the sellers signed an LOI with an individual buyer, who had formerly been a President of a similarly-focused aerospace parts fabricator.

The buyer spoke with three SBA Preferred Lenders, including a bank where he had a pre-existing relationship. In my conversations with the buyer, he shared the fact that banks employ different strategies in terms of the trade-off between the offered interest rate and flexibility shown in the underwriting process. The cleanest deals (consistent performance, no major anomalies) typically can go to the largest banks, who offer the best rates, whereas the more complicated deals may require a smaller, regional bank that will charge a higher interest rate to offset the higher perceived risk, but offer a higher probability of funding the loan.

As the buyer acknowledged that the perceived risk of customer concentration and lack of earnings consistency could be an issue for the ‘Large National Bank’ he elected to submit complete applications to a ‘Medium Size National Bank’ and a ‘Regional Bank’. As you can imagine, both banks demanded a laundry list of documents, including several years personal tax returns, personal financial statements, professional work history, and would require term life insurance, as well as third-party appraisals on the business and buyer’s home, which was required for collateral for the SBA loan.

Underwriting and Third-Party Appraisal

Once the buyer’s full application packet was received and logged at the bank’s processing department, the deal package is sent to the bank’s underwriting department, who determines whether or not the loan meets the bank’s and the SBA’s standards or if any modifications to the deal would be required (e.g. extend seller note, additional working capital required etc.). The deal package the banker sends to underwriting typically includes three to five years business financials and business tax returns, financial projections created by the buyer, possibly some marketing material created by the M&A advisor, and a narrative written by the banker and buyer. The narrative accomplishes two things: 1) gives underwriter confidence that buyer is capable of meeting the financial projections and therefore, paying back the loan and 2) proactively addresses potential underwriter concerns around the perceived risk areas (e.g. customer concentration).

The banker’s narrative document explained: 1) why the earnings were inconsistent (death in the family sidetracked owners, but business has fully recovered as evidenced by last fiscal year performance and a strong backlog of sold work;) and 2) that the perceived customer concentration is a mitigatable risk as the business works with four disparate divisions of the customer, each with separate buyers around the country, and is the only approved vendor for several parts.

While underwriting is a neutral and independent department within the bank and will render its own approval decision, it is vital that the banker communicate well with underwriting and answer all questions in a timely manner. In our case, the underwriter approved the deal within approximately three weeks, but placed a cap on the amount of rent that buyer can pay seller (seller owns the commercial property) and the amount of consulting fees the buyer could pay seller. After some discussion, the sellers accepted these conditions and the buyer felt comfortable proceeding to the next step: submitting a deposit for the third-party valuation.

At this point in the process, the bank contracts with a third-party appraiser, who will create a valuation. The appraiser is given most of the same documents that the underwriter was given (financials, tax returns, parts of the Confidential Information Memorandum, the ‘narrative’ that preempts potential appraiser concerns, etc.) Once engaged, the appraiser quickly put together a list of well-thought-out questions which the buyer satisfactorily addressed within a couple of days. Within two weeks, the appraiser completed the valuation and I was informed by the banker that the appraised value ‘met or exceeded’ the asking price. The buyer now felt comfortable moving forward with this lender and engaged his attorney to begin drafting the purchase agreement.

The purchase agreement negotiation could have commenced in parallel, but the buyer understandably did not want to incur legal fees until he knew the SBA loan would be approved. The parties subsequently spent about a month negotiating the purchase agreement.

Once the purchase agreement was signed, the closing process begins. This was approximately a five-day process where the bank and escrow work together to ensure that all documents have been negotiated and executed. The only hiccup here was that the bank required the buyer to get a new term life insurance policy, and that process took several weeks, due to its own opaque underwriting process. Once the life insurance policy was approved and all documents were executed by all parties, the bank’s closing process scheduled the funding. As soon as escrow had confirmed that they received the buyer’s deposit, the bank wired funds to escrow and the deal was officially closed on the same day and the parties rejoiced!

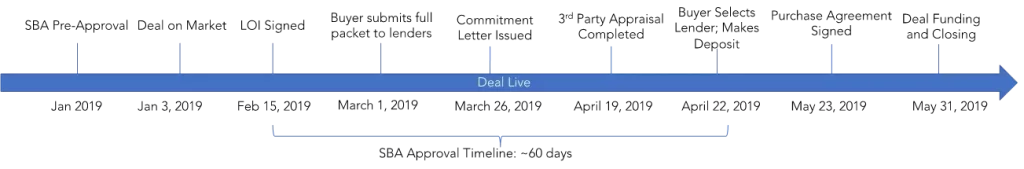

All said, this deal took 4.5 months from LOI to closing, including a very reasonable two-month SBA approval process. Here’s the timeline:

Summary of Recommendations

- Speak with Multiple Preferred SBA Lenders Early and Often – sharing financials and getting a sense of how bankers will look at the deal can be a huge time saver in the long run as you can better understand and mitigate potential landmines that can derail a deal. Speak with multiple banks as each bank may have different approach to the trade-off between the offered interest rate vs. probability of closing. The cleanest deals can often go to the largest banks offering the best rates, whereas the more complicated deals may require a smaller, regional bank that will charge a higher interest rate, but with a higher probability of funding the loan.

- Find a banker that will be pro-active and can navigate the bank – This is critical as you, the banker and buyer will be speaking almost on a daily basis. You’ll want to get comfort that banker understands the SBA process well and can navigate the myriad departments within the bank that he or she will be interacting with (e.g. processing, underwriting, closing, credit.).

- Set reasonable expectations with the Buyer– Set the expectation early that that buyer will have to agree to a Personal Guaranty, which implies that they could be pledging the family home as collateral. Naturally, this will likely require buy-in from the buyer’s spouse. In addition, there will be costs for the SBA fee, appraisals and escrow. The buyer may need to purchase term life insurance as well. It’s important that you set these expectations early in the process.

- Set reasonable expectations with the Seller – This is often the most challenging part. Sellers naturally want the highest price and optimal terms. However, your job is to demonstrate to the sellers that even if a buyer was to agree to a higher price, the buyer would need to demonstrate sufficient cash flow to pay the SBA, any seller note, a potential consulting agreement with the sellers, and elevated business expenses. In addition, the bank may add additional stipulations, such as limiting the amount of rent or consulting fees that the buyer can pay. It’s critical that the seller understand these points and maintain some flexibility throughout the process.

There are certainly many moving pieces in the SBA process. However, if you are fortunate enough to have a deal that qualifies for SBA financing, a good banker that can navigate his or her bank and the ever-changing SBA guidelines, and principals with patience and reasonable expectations, then an SBA loan can be an invaluable tool for acquisition financing.

Kevin Berson is licensed Business Broker with Seapoint Business Advisors and is based in Los Angeles, CA. He specializes in helping business owners maximize outcomes in selling their businesses. He is also the founder of Kinected, a Management Consulting firm that advises companies with strategic planning, exit planning and merger and acquisition diligence. Kevin can be reached at [email protected].